Posted on - 15 Jul 2025

As a Commodity strategist for over 20 years, the vagaries of the US dollar have always been important to me. In the Supercycle of the 2000s the weakening of the US dollar was extremely significant for copper and other base metals and, of course, there has long been a correlation between US dollar weakness and gold.

But, up until now, the Lithium and EVs supercycle has taken place against the backdrop of a strong US dollar.

No longer. It is very clear that, in recent months, the US dollar has turned a corner and most commentators agree that it has shifted towards a weakening bias. So, the question is – what does that mean for lithium prices?

I remember sitting in a meeting room somewhere in the US in 2002 while my boss explained to the commodity “expert” of a mid-tier asset manager how important a weakening US dollar would be for the commodity complex. The guy looked absolutely flummoxed and told us “I’ve been covering commodities for 20 years now and I never realised the US dollar was such a key driver”. And that wasn’t an uncommon conversation back in 2002-03 when we were right at the beginning of the China supercycle and commodities was a niche sector of the markets.

So why is a weaker US dollar good for commodity prices? Put basically it’s about cost curves and pricing.

The US dollar is the globally-accepted currency for commodity transactions. 90% of commodities in the world are quoted in US dollars. So a commodity producer’s revenue is a factor of the US$ price of that commodity.

But, depending on where a producer operates, its costs are denominated in local currency. Costs like labour, power and locally-produced consumables are all denominated in local currencies, not US$.

So, if the US$ weakens against the local currency then, in US$ terms, costs will be rising. And if costs are rising, then prices will need to rise to maintain profitability.

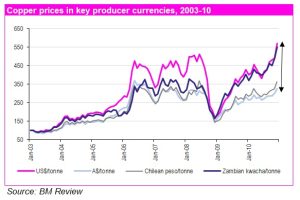

The adjacent chart (for copper) highlights the substantial differentiations that US dollar exchange rates can make in revenues and profitability.

I said above that 90% of commodity transactions in the world are carried out in US$. But the issue is that a majority of transactions in lithium are carried out in China in RMB (Yuan; CNY) terms. So is my argument still valid?

Well, I believe it is because, even though the Chinese government moved away from the US$ peg in 2005, the RMB is now run in a “managed floating exchange rate regime” which in actual terms means it keeps a close relationship with the US$, while having more day to day volatility.

Well, I believe it is because, even though the Chinese government moved away from the US$ peg in 2005, the RMB is now run in a “managed floating exchange rate regime” which in actual terms means it keeps a close relationship with the US$, while having more day to day volatility.

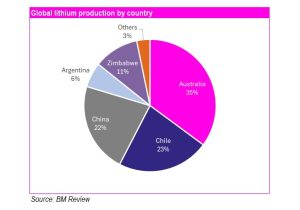

And the fact is that, if we take China as having an effectively US$ denominated currency, 75%+ of global lithium production still comes from countries whose currencies are not US$ denominated.

And if the currencies of those countries start to strengthen against the US$ going forward then it is likely to pressure margins and I believe that it will cause lithium prices to rise.

And the fact that we are in such a difficult environment for pricing currently anyway, with prices for lithium chemicals trading within the cost curve, only supports that, in my view.

So keep an eye on that US$ vs commodity currencies. It’s already started to weaken against the Australian dollar but should it weaken further or weaken against the Chilean peso or the Argentinean peso then we could very well be looking at further support for lithium prices, in my view.